Impact of Gender Board Diversity

Abstract

The proposed research will investigate the relationship between the Firm Performance, Value and Corporate Governance and Gender Board Diversity in a sample of 30 FTSE 100 companies for the period post Lord Davies Report (2011-2014). The main research question is: What is the Impact of the Gender Diversity on Firm Performance? We will also explore the following whether there is an Impact of Gender Diversity in the boardroom on the Firm Value and the Corporate Governance. We will use multiple linear regression analysis to evaluate the data. The sample for the proposed study consist of 30 companies FTSE 100 companies, which represent energy, pharmaceutical, banking, insurance and retail sectors. The stratified random sampling method was used to choose the sample. Taking into consideration previous empirical studies, we will find that there is a link between Gender Diversity in the board and Corporate performance, however results maybe inconclusive due the limitations of the study.

Section 1: Introduction

The proposed research will be undertaken as a part of MSc in Corporate Governance programme in London South Bank University. Corporate Governance is a set of rules, guidance and regulations, which companies should follow in order to be controlled and governed effectively and efficiently. That is why topics of governance and board of directors in larger listed companies attract wide-spread attention of media, public, government, shareholders and institutional investors. The board composition has been under a great scrutiny due to the various corporate failures and the last financial crisis. In order to improve the board decision making, effectiveness and problem-solving processes, researchers are looking into the issue of the Board Gender Diversity. The perception of women is changing and women are trying to advance in their careers by competing with male for the jobs in the board of directors. However there should be valid external and internal justifications for Gender Diversity in the Boardroom and its impact on the Firm’s Performance. Carter et al (2003) identify a positive link between Gender Diversity and Firm’s value, which is calculated by Tobin Q and highlights that Diversity increases the efficiency of the audit. Catalyst study (2004-2008) used ROE Return on Equity) and return on invested capital (ROIC) of 353 US companies to measure firm’s value and they found that companies with higher female representation in the board of directors perform better financially than companies with lower female representation. Francoeur ( 2007) on the basis of Catalyst study findings indicates that ‘’firms operating in complex environments that have a high proportion of women officers do experiment positive and significant monthly abnormal returns of 0.17%, which can intuitively be extrapolated to a 6% return over 3 years.’’ Campbell and Minguez-Vera (2008) has looked into the impact of gender diversity on both: external and internal measures.

Adams and Ferreira (2009) establish that women on boards help to monitoring managers more effectively however he points out also a negative relationship between the proportion of women on the board and Tobin’s Q. The purpose of the intended research is underpinned by the personal interest of the researcher in the Gender Board Diversity and its impact on Firm’s Performance, Firm Value and Corporate Governance. The intended research offers to provide insight into the relationship between Firm Performance, Firm Value and Corporate Governance and the Gender Board Diversity in 30 FTSE 100 companies. The proposed study will contribute to knowledge base for this topic as it will cover the period after Lord Davies Report was published (2011-2014). Empirical works indicate that the topic was researched in various developed countries mainly on the subject of Corporate Performance and Gender Board Diversity however further research is needed as previous evidence for FTSE 100 companies were not conclusive and ambiguous. In addition to this, association Board Gender Diversity and Corporate Governance has not been investigated thoroughly. We propose the following main research question: What is the impact of Gender Board Diversity on Firm Performance?

Sub-questions

- What is the Impact of Gender Diversity on Firm Value?

- What is the Impact of Gender Diversity Corporate Governance?

- Is Norwegian Firms Performance improved after introduction of mandatory quotas on the female board representation?

Having reviewed the theoretical and empirical evidence and in line with the main research question and sub-questions we would like to test following Hypotheses: H1 There is a positive relationship between Gender Diversity in the boardroom and Firm Performance. H2 There is a positive relationship between Gender Board Diversity and Firm Value Corporate governance support diversity by creating association between diversity and directors’ responsibilities to discharge their main duties. Firstly, we think about the duty of care, skill and diligence. Secondly - directors’ duty to take into account the interests of relevant stakeholders, while promoting the success of the company as a whole. That is why we would like to investigate the relationship between them: H3 There is a positive relationship between Gender Board Diversity and Corporate Governance. The proposed study will consist of 5 Chapters: Chapter one: Introduction will give an overview of the diversity and its importance for the board composition and it will provide female and male representation in FTSE 100 companies. It will discuss the Internal and External Monitoring measures, which impact Firm’s Performance in order to give the reader a better view and understanding of the topic. It will analyse Board Diversify Policies and see their justifications and reasons to have a gender diverse board. Companies need to explain their policy on boardroom diversity in accordance to the UK Corporate Governance Code; this requirement came into force on 1st October 2012.

Theoretical Framework and Literature Review

This Chapter of the proposed study will focus on theories and previous empirical studies. Chapter three: Research Design, Methodology and Data The most important Chapter in the proposed study will discuss the type of research, methodology, statistical methods, and will give the description and definition of key independent and dependant variables, null and the alternative Hypotheses. Chapter four: Presentation and Interpretation of Results will provide an overview and draw conclusions from the data analysis. It will also involve discussion on findings. Chapter five: Summary, Conclusions and Recommendations will discuss possible benefits and disadvantages of having mandatory quotas on gender diversity and compare policies around the world. It will provide barriers of getting women into boardroom and it will touch on the issue of ‘glass ceiling’. We will try to identify ways to shatter the glass ceiling into tiny pieces and attract more women into the boardroom. Possible ways could be widening the search and selection for Corporate Senior Management Team by including candidates from voluntary and public sector and trying to engage investors in board diversity. The Equality and Human Rights Commission will undertake a study to analyse the board-level recruitment practices in the FTSE 350 this year.

Section 2: The Literature Review

Literature review was submitted already. Literature review intended to establish theoretical framework for the research proposal. It looked into current knowledge and ideas, which are already established on a topic. Literature review is a secondary source; however it is an essential part of the research process and will help out with the proposed research.

Section 3: The Research Methodology and the Data

The research methodology consists of two approaches: qualitative approach and quantitative one. First method is concerned on obtaining information by interviewing the ‘human subjects’ on the topic of the research. The interviewing is done via face-to-face communication or a request to fill the questionnaires and/or surveys. This type of research method is relies heavily on words whereas quantitative use numbers. Quantitative research method seeks to establish statistical relationship between variables and generalize results to the targeted audience from which the sample was chosen. The vast majority of studies on Board Diversity have used quantitative data analysis that is why we decided that this will be more appropriate method for the proposed research. In addition to this, we know the quantitative approach will be useful due the fact that it is difficult to engage FTSE 100 directors in interviews. Top Executives’ diaries are very busy. The proposed study will analyse the relationship between Gender Board Diversity and Firm Performance, Firm Value and Corporate Governance Score for a sample of 30 UK FTSE 100 companies observed during the period 2011-2014. That is why it will be a descriptive research as it will investigate association of 3 variables. The years 2011 to 2014 were selected because the proposed study seeks to explore changes in Firm Performance, Firm Value and Governance after the target of 25% women on boards was set by Lord Davies report in 2011. The data will be obtained from FAME (Financial Analysis Made Easy) for a sample of 30 companies, which provides financial information including ratios on major public and private U.K. and Irish companies.

We also will use 2011-2014 annual reports of the companies. That is why data for the proposed study will include archival data. We decided to use annual reports as additional source because these reports are publicly available and data is subject to compliance with London’s Stock Exchange listing regulations and Companies Act 2006. Additional source of data will be FTSE4Good ESG Ratings service, which will provide information about Corporate Governance Rating for large and mid cap stock. We will rate companies on 5 different areas: remuneration of executive and non-executive, EDs and NEDs stock ownership, shareholders rights, independence of the audit process. All three sources of data are secondary. There are many methods of sampling to choose from when someone is doing research. We decided to use a stratified random method because it helps us to obtain a sample of companies with varied gender representation. The main reason of using stratified sampling is we select gender as a stratum and choose from companies from energy, pharmaceutical, banking, insurance and retail sectors.

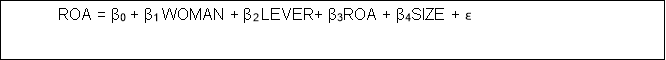

The proposed research will be a cross-sectional study as it will compare the same 30 FTSE companies at a same point in time. We think that the cross sectional analysis is the most appropriate for the proposed research as it gives an opportunity to the researcher to compare different variables at the same time. We will use multiple linear regression analysis method to interpret collected data. Multiple regression is a ‘’technique when or more independent or explanatory variable is used to predict the value of the dependent variable . The analysis estimates parameters for the following regression equation the coefficients for the p explanatory variables εi = the residual We will use Ordinary least-squares (OLS) regression, which is used for ‘’linear modelling technique that may be used to model a single response variable which has been recorded on at least an interval scale. The technique may be applied to single or multiple explanatory variables and also categorical explanatory variables that have been appropriately coded. Taking into consideration the research question, we can make some assumptions about the topic of study. The alternative hypotheses and the corresponding null hypotheses are:

| Hypothesis1 H(A1) | There is a relationship between Gender Board Diversity in the boardroom and Firm Performance. |

| H01 | There is no relationship between Gender Board Diversity and Firm Performance. |

| Hypothesis2 H(a2) | There is a relationship between Gender Board Diversity and Firm Value. |

| H02 | There is no relationship between Gender Diversity and Firm Value. |

| Hypothesis 3 (Ha3) | There is a relationship between Gender Diversity and Corporate Governance Score. |

| H03 | There is no relationship between Gender Board Diversity and Corporate Governance Score. |

To test H1 & H2 we will use three sets of variables: independent, dependent and control variables. We will only change the dependant variable for performance we will use Return on Assets ratio (ROA) and for Firm value we will use Tobin Q ratio.

The empirical model to test H2 will be as follows: Q Dependant variable representing Tobin Q as a measure of firm value, firm i at time t

| Woman Firm Size Lever ROA | 2 independent variables 1) dummy variable, which equals to 1 for the boards of directors, with one female on board and 0 for the boards with no female board representation ( DWOMAN) 2) percentage of women directors on the board ( PWOMAN) 3 remaining are control variables Firm Size on the basis of Total Assets, firm i at time t Leverage , firm i at time t Return on assets i at time t |

H3 Hypothesis model  CGR Dependant variable representing Corporate Governance Rating as a measure of governance compliance firm i at time t Having prepared the above models we have taken into consideration multicollinearity. Multicollinearity occurs when two or more independent variables are inter-correlated and as result correlated variables contribute redundant information. We believe that predictor variables will be mean centred however a small sample can involve a degree of multicollinearity. We also need to be aware that heteroscedasticityoften arises in the analysis of cross-sectional data and it relates to the error terms The proposed study will use both financial and non-financial data on a sample of 30 listed companies, thus n= 30.

CGR Dependant variable representing Corporate Governance Rating as a measure of governance compliance firm i at time t Having prepared the above models we have taken into consideration multicollinearity. Multicollinearity occurs when two or more independent variables are inter-correlated and as result correlated variables contribute redundant information. We believe that predictor variables will be mean centred however a small sample can involve a degree of multicollinearity. We also need to be aware that heteroscedasticityoften arises in the analysis of cross-sectional data and it relates to the error terms The proposed study will use both financial and non-financial data on a sample of 30 listed companies, thus n= 30.

The level of significance α = 0, 05. We anticipate that we will do statistical analysis on Microsoft Excel first and then on Statistical Package for the Social Sciences (SPSS). SPSS is one of the most popular and powerful statistical software packages that cover a broad range of statistical procedures, which allows a researcher to summarise data. The researcher was using publically available data and the references used material will be provided in the Bibliography. There are no issues relating to ethical concerns. Nevertheless, the researcher will abide by the LSBU Code on ethics.Similarly to the previous research findings we believe that there will not be conclusive evidence that Gender Diversity impacts the Firm’s Performance. However having a diverse board – whether it’s women, different ethnic origins and different experience – is important because companies get a better spread of experience and sensitivity to different knowledge and understanding of how business works through diversity.

In addition to this, having some women representation on a board can be helpful because of the different type of sensitivity women bring. UK approach to quotas currently is voluntary, but there is a possibility of a mandatory approach if voluntary measures don't work. However a voluntary, business-led approach is showing results at the moment. When the Lord Davies’ report was published, situation with the female representation was 12.5% in 2011; now 20.7% in 2014. At the time this target should not be used just to put a woman on the board to tick the box for compliance with the report. Implications of the proposed research for identified stakeholders such as companies themselves, women and men, government and society in general will be as follows: companies - gender diverse workforce in the boardroom has an economic potential. It will help companies influence and attract their target market. We know that women make up around 70% consumers. So by ensuring staff are representative of this market they will be able to understand the products or services they need. The study will imply that women should have an equal have equal opportunity getting into the top jobs and that competition between men and women should not be centred on their gender but their capabilities to do the job. Government will have further reasons to implement their target for female board representation. The target of 25% for women on the boards of FTSE 100 companies was set at to be achieved by 2015 when Lord Davies published his report in 2011.

The steady progress has been made now 36 FTSE 100 boards have exceeded this. It may also encourage current government to promote women into the ministerial posts. This study will give provide further evidence that the change in the perception of women in society is needed and Gender Equality will benefit everyone. The proposed study will take one year to complete and it should be finished by December, 2014. The researcher anticipates that the literature review will take up the most of the time. Majority of the relevant material have been already identified and reviewed. The researcher used and will use specific management databases such as, Emerald Insight, Science Direct, IDS, which are searched using keywords such as gender diversity, board of directors, performance measurement, board diversity as well as internal and external performance measures. The search has produced a list of articles abstracts, which will follow by full text reviews. Articles were analysed using the pro-forma table given by the tutor and supplemented with main books in the areas of the research. The references will be done using Harvard Referencing System. The next steps will be to compile the data and analyse it by using the proposed methods of analysis. The last and the most important part of the proposed study will be to evaluate the findings.

Cite this page

Impact of Gender Board Diversity. (2017, Jun 26).

Retrieved March 4, 2026 , from

https://studydriver.com/impact-of-gender-board-diversity/

Stuck on ideas? Struggling with a concept?

A professional writer will make a clear, mistake-free paper for you!

Get help with your assignmentLeave your email and we will send a sample to you.

Perfect!

Please check your inbox