An Overview of ABC Plc

Company Overview

ABC Plc, a large multinational Oil and Gas Company, operates in USA, UK and Japan and its main activities are drilling, refining and distributing oil and gas. ABC Plc has not been making profits for the last 3 years in USA and Japan due to severe economic recession and management is planning to cease US and Japanese activities because of continuous loss. Current profit and loss account of the company performance reveals the following information. Above calculation of ABC Plc’s profit and loss shows that company is facing hurdles in U.S and Japan operations are in severe loss especially in U.S business. In order to affirm the company’s decision to close the U.S and Japan operation, analysis of all countries in which company operation is required. Following is the overview of the company country based operations.

UK operation Overview

UK’s majority Oil reserves are located offshore in the UK continental shelf (UKCS), and most of the oil production occurs in the central and northern sections of the North Sea. Even though on shore there is a diffident amount of oil produced, in 2012 more than 90 percent of total UK production were offshore. (United Kingdom Analysis, 2013) Although UK’s reservoirs are aging and infrastructure have been affected the oil production in last few years, The government of UK does not hold any direct interest in oil production, but this sector remains important to the government because Corporation Tax and Supplementary Tax income comes from the Oil sector and accounts almost 25 percent of corporate tax receipts, according to Oil and Gas UK.

Tax Changes in UK

There have been a number of tax changes from 2011 that affected the sector, which includes the change in the rate of supplementary charge (an addition to the corporate tax). Furthermore, petroleum revenue tax (PRT) is increased to 81 percent of their profits (previous 75% rate), and fields that are not subject to PRT now pay a 62% tax (50-percent rate in the past). (United Kingdom Analysis, 2013) Because of the increase in taxes most of the UK projects have become less competitive. Operating cost increase with higher taxes has resulted in decreased investment. Even without the increased taxes, operating costs in the UK were very high which also discourage investors.

U.S.A Operation Overview

U.S Oil production has boomed from last decade making U.S to less rely on oil imports and other countries. But this increase has come with the greater cost. Also it is speculated that this boom will not last more than a decade resulting in depletion of resources and maturing the reserves. Big players in the sector are profiting from the boom but increased legislation and laws including labor etc. making it difficult for the small firms to survive and continue production. Cost Inflation rate in USA is increasing making companies more to spend on operations without meeting the demand to increase activity and production volumes. Also the price changing un-certainty challenging the capital budgeting and estimated net income, large expansion and development is also on going. It will be hard to invest in new sites for small players.  Figure 1

Figure 1

- U.S Energy Information Administration

Japan Operation Overview

Japan is the world's largest liquefied natural gas importer, second largest coal importer, and third largest net oil importer. Domestic oil reserves are very limited, according to theOil and Gas Journal(OGJ). Reserves amounted 44 million barrels as of January 2013. Japan's domestic oil reserves are found primarily along the country's western coastline.(Japan Analysis , 2013) Because of the deficiency in reserves and recent climate changes after Fukushima incident Japanese government and energy companies have decide to pursue active participation in investing oil and natural gas projects overseas. To meets its oil consumption demand Japan relies almost solely on imports. Government controls oil stocks to maintain the supply without any interruption. Total strategic crude oil stocks in Japan were 590 million barrels at the end of December 2012, According to the International Energy Agency. In this stock 55% were government stocks and 45% commercial stocks. Because of the reserve declining Japan's natural gas production has been low and flat for over a decade. In 2012, production was 116 Bcf, a decline from an average of 185 Bcf over the past 10 years.

Tax and Licensing Cost

Congo’s Licensing Laws are in accordance with Production Sharing Agreements (PSA’s) and very favorable for investors. The laws take oil production royalty of 15% from investors with transportation and processing costs, reducing the rate to 12-14% and a gas production royalty of 5%. Oil recovery cost is up to 70% of total production is negotiable while exploration costs and operating costs are recoverable. Congo’s corporate tax rate is 35%. (OiI and Gas Industry Regulation in Congo, 2014) Following Figure 1 shows the Oil production and Consumption in Congo:  Figure 2

Figure 2

Local Analysis

Most of the foreign companies investing and operating in Congo are utilizing the local content for human resources, selecting suppliers and involving in community activities to boost the trust of local population. This act not only providing social and economic benefits but also help’s to create a stable relationship with the local host communities. ABC PLC should also consider this fact as an important aspect while recruitment of human resource and vendor selection process.

Economic Development in the region

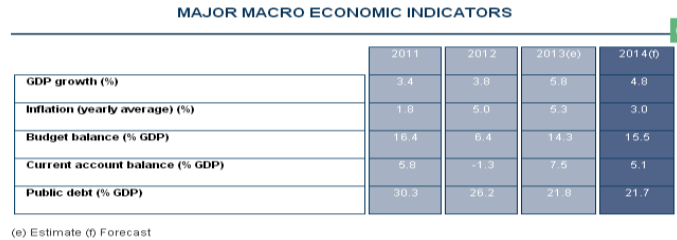

Congo lies in Sub-Saharan Africa and economic growth in this region has up in 2013, region’s GDP grew to 4.7%, growth was higher at the rate of 6%. FDI are coming in the region exploiting not only oil but gas and mining sectors as well. The Net FDI calculated for the region was 4$ billion in 2013. (CONGO (BRAZZAVILLE), 2014) Following is the table showing the GDP growth of Congo in past few years.  Figure 3

Figure 3

Risk Factors

Following is the risk factor analysis for ABC Plc for investment in the developing country. It must be clarified that most of these risk factors cannot control by the ABC Plc and can affect the business.

Economic Condition

The demand for oil products are directly related to the general economic growth. Demand can be interrupted by recession or negative/low economic growth. Major changes in region including civil unrest can also harm the demand. Financial markets and institutions changes can also pose serious risk to the company.

Legal un-certainty

Countries in this region including Congo have no well-developed legal system. Although the regulatory authority for Oil and Gas is present and working with investors to implement changes, but still the risk is present of any unpredictable action by government can make the business difficult for company.

Regulatory and Tax Risk

Although the government of the region are amending the laws and providing good terms to encourage foreign investors but the risk is remain to any change in laws including the international agreements can adversely affect the business. Any increase in corporate tax or royalty fee can harm the future profits of ABC Plc’s investment in Congo.

Security Concern

Successful operation can be disrupted by local communities in case of any civil unrest or labor union crisis making it impossible to continue operation or in worst case cause great costs for security or closing down the operation for a period of time.

Efficient Operation

ABC Plc’s performance will depend on how company can perform competitively given the nature of few but big players in the sector. It will depend on the ability to manage the cost and expenses and improve production for the total term of business. This requires an efficient management with focus on utilizing right technology working with the best vendors and controlling cost.

Customer Analysis

Following figure shows the major customers of the Congo oil products. This ensures for ABC Plc that investing in the region is a right decision or not. Congo’s reserves are mostly un-utilized and in coming years the production will increase significantly. Also more FDI in the region will open the new markets for the oil investing companies.  Figure 4

Figure 4

Recommendations

After analyzing the U.S, UK and Japan Current situation and future investment opportunities for the ABC Plc in developing country, following recommendation has been suggested.

- U.S and Japan operation of company is causing a great loss and continuing it will harm the company and even cost to closing the business.

- ABC Plc operation in UK is profitable for the company but not in the long run, increasing cost will affect the business.

- It is imperative to further invest in other countries and close the U.S and Japan operation as Japanese government and oil production companies are also seeing opportunities to invest in other countries.

- ABC Plc can invest in any country in the African region but Congo will be the best case choice, as government is welcoming the FDI’s and have less restriction and barriers to entry.

- For investment in any country Supply is one of the vital factors and Congo has abundant resources in reserves which needs further exploration, making it impossible to decrease in future supply.

- Congo’s current oil customers include big countries hence the demand is speculated to be un-interrupted or lessen in coming years.

- Congo has a relatively calm political situation as compared with other small developing countries. Making it a good opportunity for investors.

ABC Plc planning for investments in developing region affirm by the proposed project’s capital budgeting. Projects PBP, NPV and IRR (interpolation method) has been calculated in order to take the right decision. Projects life has been estimated for four years with the PBP of 3.5 Years. PBP shows that in 3 years company will recover the initial cost of investment in the region. NPV of project investment at 7% rate suggests that project is profitable and will generate good revenue. This revenue increase will also helpful to the ABC Plc for their future investment plans and the positive NPV will increase the value of firm as well. Project’s IRR has been calculated at 7% and 14% rate which show that project is acceptable at 7% and above rate but less than 13%. IRR suggests that projects should be acceptable as far as the IRR is greater than the cost of capital rate which in this case is 7%.

Cite this page

An Overview of ABC Plc. (2017, Jun 26).

Retrieved July 13, 2025 , from

https://studydriver.com/an-overview-of-abc-plc/

Stuck on ideas? Struggling with a concept?

A professional writer will make a clear, mistake-free paper for you!

Get help with your assignmentLeave your email and we will send a sample to you.

Perfect!

Please check your inbox