Overview of the Johor Corporation

CHAPTER 1 1.1OVERVIEW This chapter describes the background of company Johor Corporation, Wakaf Dana Niaga, and entrepreneurship element in Wakaf Dana Niaga. The first part of chapter explains about the background of Johor Corporation. Meanwhile the second part explains a brief background of Wakaf Dana Niaga as Islamic Corporate Social Responsibility- Endowment.

Finally for the last part of this chapter, problem statement, objectives, research hypothesis, and scope of study are described. 1.2.BACKGROUND OF JOHOR CORPORATION Via Johor Enactment No. 4 1968 (as amended under Enactment No. 5, 1995), Johor Corporation (JCorp) was recognized as a public enterprise and a constitutional body and as a State Investment Corporation, JCorp positions among the nation’s largest multinationals, with core business sectors covering Palm Oils, Foods and Quick Service Restaurants, Specialist Healthcare Services, Hospitality, Property & Logistic/Services as well as Intrapreneur Business (Johor Corporation, 2011) This research is based on Corporate Social Responsibility applied by JCorp under administration of WANCorp. WANCorp is stand for Waqaf An-Nur Corporation Berhad, and it is a limited company established to assurance proper management of Johor Corporation and its Group of Companies’ stocks and assets under endowment. WANCorp serves as ‘Maluku Alibi’ to stocks and other forms of the company’s security that has been put under endowment as a whole. WANCorp is also in authority on behalf of Johor Corporation’s Corporate Social Responsible initiatives to accomplish Waqaf An-Nur Hospital (HWAN) & chain of clinics (KWAN), Waqaf Dana Niaga, Waqaf Brigade and subsidising to the public through ‘fi sabilillah’ benefit sharing. The ‘fi sabilillah’ benefit sharing programme by Waqaf An-Nur has coped to benefit patients’ welfare, livelier mosques, entrepreneurial and educational programmes. Contributions were also stretched internationally through Somalia Humanitarian Aid and GAZA Humanitarian Fund. For the year 2011, WANCorp issued RM945,502.13 for contribution commitments and ‘fi sabilillah’ benefit sharing (Johor Corporation, 2011). 1.3.WAKAF DANA NIAGA The significant area will be discuss in this research is Waqaf Dana Niaga, one of the obligation of WANCorp. Waqaf Dana Niaga is a cash endowment program whereas WANCorp is prepared and organized fund for entrepreneurs to sort out the business and pay back without any interest, totally clear from riba and gharar.

Wakaf Dana Niaga is the describing of cash endowment or wakaf, while WANCorp performance as Microfinance Institution. In other words, cash wakaf is used as strategic investment in relieving poverty and economic deficiency as well as education, health and research and microfinance almost does the same (Adam, 2013). It’s performance not such as bank loan, or other financial institutions that gain the profits from giving the fund to the borrowers. Refer to Shukri Adam et . Al (2013), microfinance is the financial services for unfortunate and low income clients offered by dissimilar types of services providers.

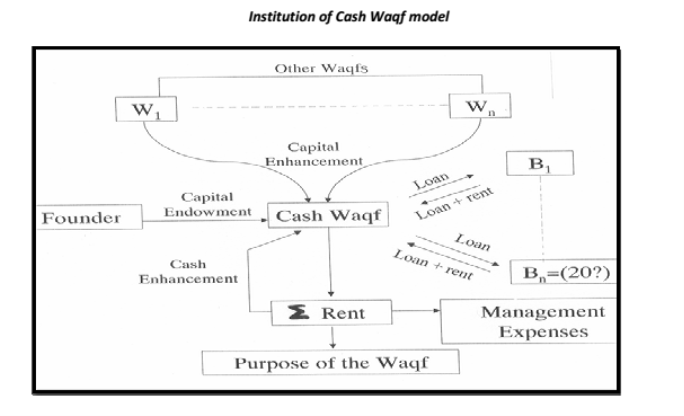

The type of services are be subject to on the institution that giving the fund, on what purposes. But in this case, WANCorp is responsible as microfinance institution that gives the fund to poor and low income client based on the consecutively business matter. The clients should be entrepreneurs that derive from different business background. Here is attachment of the process of cash endowment model for Islamic MFI;  Figure.1.1. Process of Cash Endowment Model for Islamic MFI (Lahsasna, 2009) From the figure above, the process is starting with presence of Waqaf founder, which is in this circumstance, an organization namely as Johor Corporation, and appointment of trustee as fund manager is responsibility of WANCorp. WANCorp has implemented many types of corporate social responsibility such as build hospital, and clinics, but in this cash endowment for entrepreneurs, there must has one specific management team that monitoring the programme from beginning process until finish.

Figure.1.1. Process of Cash Endowment Model for Islamic MFI (Lahsasna, 2009) From the figure above, the process is starting with presence of Waqaf founder, which is in this circumstance, an organization namely as Johor Corporation, and appointment of trustee as fund manager is responsibility of WANCorp. WANCorp has implemented many types of corporate social responsibility such as build hospital, and clinics, but in this cash endowment for entrepreneurs, there must has one specific management team that monitoring the programme from beginning process until finish.

Cash Endowment under Wakaf Dana Niaga will be an investment of the funds in equity or known as debt financing to the borrowers. Masyita (2003) stated that the micro financing programs which use loss profit sharing are one of the most significant sectors for poverty alleviation. Those investments are divides by two type of risk investment which are high risk investment and low risk management. High risk investment has Musharakah and Mudarabah fundamentals. Musharakah means relationship recognised under a contract by the joint consent of the parties for sharing of profits and losses, arising from a mutual enterprise or venture and profits shall be spread in the proportion mutually agreed in the contract.

[2] Its easily defined as profit-loss sharing.

Mudarabah refers to the payment of a specific amount of money to a person who uses it for business and makes a profit from it, or an investment.

[3] While low risk supervision has Murabaha and Ijarah elements. Murabaha refer to the sale of goods at a price, means borrower should pay back loan concept and it’s free from riba and gharar while Ijarah means tenancy, rent or wage. Generally, the Ijarah theory refers to selling the benefit of use or service for a fixed price or wage [4].  Figure.1.2. Structure of Cash Waqaf Account Fund Mobilization and Investment (Ahcene Lahsasna et. Al 2009) Refer to Ahcene Lahsasna (2009), figure above shows the arrangement of cash wakaf account fund mobilization and investment that used in SME Microfinance in Malaysia. Cash Waqaf that organize by WANCorp is known as contributions endowments, by giving cash capital under ‘Card Hassan’ platform, and the money will distribute to poor people and needy.

Figure.1.2. Structure of Cash Waqaf Account Fund Mobilization and Investment (Ahcene Lahsasna et. Al 2009) Refer to Ahcene Lahsasna (2009), figure above shows the arrangement of cash wakaf account fund mobilization and investment that used in SME Microfinance in Malaysia. Cash Waqaf that organize by WANCorp is known as contributions endowments, by giving cash capital under ‘Card Hassan’ platform, and the money will distribute to poor people and needy.

This cash is belong to private owner which mean Johor Corporation, and has trustee (WANCorp) who’s responsible to manage the money. The trustee can be an owner or someone else. Since this cash wakaf is charity programme; the profit from investment must channel to charity too. The basic argument of those, who opposed the cash wakaf was based on a seemingly powerful point: once endowed, the corpus of a wakaf belongs to Almighty Allah( Shukri Adam et. Al,2012 ). The cash wakaf will distribute to the borrowers, which are needy and poor people. But what belongs Allah, the opposition argued, cannot distribute to third persons (Shukri Adam et. Al, 2012). Below, the figure is about Prof.

Murat Cizacka’s model of cash wakaf shows in what manner the revenue would be channelled to microfinance institutions.  Figure.1.3. How Revenue Should be Channel to MFI( Murat Chizacka ) Cash wakaf is a form of movable wakaf property which is structured by money with the leading purpose to be in service for religious and charitable projects for the people for the sake of Allah (Shukri Aam et.Al, 2012). On the other way, the profits advantage from investment is used for any other commitments such as pay utilities, donation, and salary and invests again as cash wakaf. 1.4.ENTREPRENEURSHIP The entrepreneurs in this platform have selected by the board of directors before they can take part in the Waqaf Dana Niaga program. They should be Muslims and have some standards that pass the rules and regulation specified by WANCorp since based on annual report, 532 applications were accepted however only 272 were approved by top management to get business loan.

Figure.1.3. How Revenue Should be Channel to MFI( Murat Chizacka ) Cash wakaf is a form of movable wakaf property which is structured by money with the leading purpose to be in service for religious and charitable projects for the people for the sake of Allah (Shukri Aam et.Al, 2012). On the other way, the profits advantage from investment is used for any other commitments such as pay utilities, donation, and salary and invests again as cash wakaf. 1.4.ENTREPRENEURSHIP The entrepreneurs in this platform have selected by the board of directors before they can take part in the Waqaf Dana Niaga program. They should be Muslims and have some standards that pass the rules and regulation specified by WANCorp since based on annual report, 532 applications were accepted however only 272 were approved by top management to get business loan.

The applicants originated from many places all around Johor and Negeri Sembilan. Formerly, entrepreneurship can be the capability and readiness to develop, establish and manage a business speculation along with any of its risks in order to make a turnover [5]. Entrepreneurship is a progression of classifying and preparatory a business project, obtaining and organizing the required resources and captivating both the risks and prizes associated with the venture. Entrepreneurs used their skill to syndicate many sources such as land, labour, natural resources, and capital so that they can generate the profits. They are required strong inner self that categorized by innovation and risk-taking, and is crucial part of ability to succeed in the business and has competitive element globally.

Entrepreneurship element in this program Wakaf Dana Niaga is WANCorp give the fund to the person that has interest to do business dealing, based on their business background, after do some research about the potential of their business. Generally, entrepreneurship is the process of determining different methods of combining resources. When the market value produced by this new mixture of resources is greater than the market value these resources can generate elsewhere individually or in some other combination, the entrepreneur creates a profit.  1.5.THEORETICAL FRAMEWORK

1.5.THEORETICAL FRAMEWORK  1.6.PROBLEM STATEMENT Currently, the main problem related with implementing wakaf arrangement by many organization in Malaysia is the low creation rate of successful entrepreneur from the program, spontaneously the effect is the company became loss in capital and has undesirable influence on the fund given after provided some amount of money to the entrepreneurs, and objective of the company to be successful in wakaf program is unachievable. 1.7.OBJECTIVES The main objectives of research are: •To explore the most critical success factor of entrepreneurs from Wakaf Dana Niaga •To identify the existence of Islamic Microfinance can support the success of the entrepreneurs. 1.8.RESEARCH QUESTION 1. What is the most critical success factor of entrepreneurs from microfinance program? 2. Is the existence of Islamic microfinance supporting the success of entrepreneurs? 1.9.SCOPE OF RESEARCH This research is study about three critical factors that can be a motive of entrepreneurs to be successful, which are psychological and personal skills, management skills and training, and external environment. These three critical factors of entrepreneur’s success were developed by Benzing. Besides that, the researcher also wants to study the impact of the existence of microfinance in helping the entrepreneur’s success.

1.6.PROBLEM STATEMENT Currently, the main problem related with implementing wakaf arrangement by many organization in Malaysia is the low creation rate of successful entrepreneur from the program, spontaneously the effect is the company became loss in capital and has undesirable influence on the fund given after provided some amount of money to the entrepreneurs, and objective of the company to be successful in wakaf program is unachievable. 1.7.OBJECTIVES The main objectives of research are: •To explore the most critical success factor of entrepreneurs from Wakaf Dana Niaga •To identify the existence of Islamic Microfinance can support the success of the entrepreneurs. 1.8.RESEARCH QUESTION 1. What is the most critical success factor of entrepreneurs from microfinance program? 2. Is the existence of Islamic microfinance supporting the success of entrepreneurs? 1.9.SCOPE OF RESEARCH This research is study about three critical factors that can be a motive of entrepreneurs to be successful, which are psychological and personal skills, management skills and training, and external environment. These three critical factors of entrepreneur’s success were developed by Benzing. Besides that, the researcher also wants to study the impact of the existence of microfinance in helping the entrepreneur’s success.

The questionnaires were distributed to entrepreneurs from Wakaf Dana Niaga to achieve actual data associated with objective of research. 1.10.ORGANIZATION OF THESIS This thesis has been prepared to give details on the facts, observations, arguments, and information in order to meet its objectives. Chapter one generally gives the brief background of the company Johor Corporation, background of Wakaf Dana Niaga, entrepreneurship element, the problem statement, objectives, research question, and scope of research. Chapter two presents the literature review of Corporate Social Responsibility, wakaf as financial responsible and critical factor of success entrepreneurs in that program, and also future opportunities are being discussed. Chapter three carries out the presentation of detailed work done during this research.

Cite this page

Overview of the Johor Corporation. (2017, Jun 26).

Retrieved July 14, 2025 , from

https://studydriver.com/overview-of-the-johor-corporation/

Stuck on ideas? Struggling with a concept?

A professional writer will make a clear, mistake-free paper for you!

Get help with your assignmentLeave your email and we will send a sample to you.

Perfect!

Please check your inbox