Financial Performance of ABC Ltd

Accounting is concerned with collecting, analyzing, and communicate accounting information. The accounting information is helpful to those people who make plans about business and in making important decisions related to the business

The aim of this paper is to evaluate the financial position of the company and the importance of credit manager to achieve credit sales targeted and importance of actual figures when estimating the budget.

This paper consists of two main sections. In the first part, evaluation of the financial position of ABC Ltd uses gross profit margin and net profit margin. The second part concentrates on things need to consider when preparing the budget in order to prevent from biased budget.

Part A

- A)

|

Account |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

|

Sales |

296700 |

296700 |

370875 |

445050 |

|

Cost of sales |

176900 |

198128 |

229970 |

283040 |

|

Gross profit |

119800 |

98572 |

140905 |

162010 |

|

Selling and distribution expenses |

35600 |

40940 |

47348 |

57672 |

|

Administration and general expenses |

45900 |

49113 |

52785 |

56457 |

|

Financial expenses |

15800 |

15484 |

15168 |

14536 |

|

Net profit |

22500 |

(6965) |

25604 |

33345 |

- Evaluate the financial performance of ABC Ltd. Over the four year period.

Financial ratio examines the financial health of the business. It helps to identify the financial strengths and weakness of the business. By calculating the ratio, it is possible to provide a good picture of the financial position and performance of a business. Financial ration can be represented in numerous ways. For example, as percentage, as fraction and as proportion. Financial ratio can be classified into profitability, efficiency, liquidity, gearing and investment.

ABC Ltd company’s financial performance is evaluated by using profitability ration of gross profit margin and net profit margin. Gross profit is the difference between the sales and cost of sales. And the ratio is a measure of profitability in buying ad selling goods and service before any other expenses are taken into account.

For example:

Gross Profit Margin = Gross Profit x100

Gross Profit Margin = Gross Profit x100

Sales

= 119800/296700 x 100

= 40%

Gross profit for the year one is 40%.

The most appropriate measure of operational performance for comparison purposes is the Net profit margin ratio. The factors which influence the net profit margin of a business are the degree of competition, type of customer, economic climate and industry characteristics.

For example:

Net Profit Margin = Net profit before interest and taxation x 100

Net Profit Margin = Net profit before interest and taxation x 100

Sales

= 22500/296700 x 100

= 8%

Net Profit Margin for the Year one is 8%

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

|

|

Gross Profit Margin (%) |

40 |

33 |

38 |

36 |

|

Net Profit Margin (%) |

8 |

(2) |

7 |

7 |

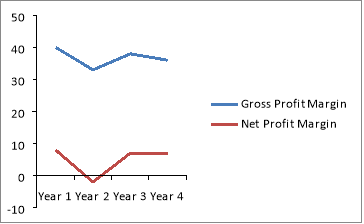

Gross profit margin of ABC Ltd company has fallen down from 40% to 33%. And again increased to 38% and fall down to 36%. The decrease of the gross profit margin of ABC Ltd was a result of high production cost of the company. The raw material used to produce goods and services has increased. As a result the company is experiencing less gross profit margins.

Nonetheless, the Net profit margin of ABC Ltd has been maintained for the last two years, Year 3 and Year 4. Whereas in Year 1 company had a high net profit margin and it gradually decreased and company experience loss of (2) % of Net profit margin. This may be because the company’s Gross profit margin decreased from 40 to 33 and affected the company’s net profit margin. Moreover, it may be the reason that, the company has high expense such as high selling and distribution expense, Administration and other general expenses. After experiencing a loss in Year 2, company gain 7% of net profit margin in Year 3 and year 4 also. This shows company has minimized their expenses and cost of sales and increase their revenue by generating more sales.

Below show graphical demonstration of ABC Ltd financial performance.

|

Account |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Trend |

|

Sales |

296700 |

296700 |

370875 |

445050 |

Increased by 148350 |

|

Cost of sales |

176900 |

198128 |

229970 |

283040 |

Increased by 106140 |

|

Gross profit |

119800 |

98572 |

140905 |

162010 |

Increased by 42210 |

|

Selling and distribution expenses |

35600 |

40940 |

47348 |

57672 |

Increased by 22072 |

|

Administration and general expenses |

45900 |

49113 |

52785 |

56457 |

Increased by 10557 |

|

Financial expenses |

15800 |

15484 |

15168 |

14536 |

Decreased by 1264 |

|

Net profit |

22500 |

(6965) |

25604 |

33345 |

Increased by 10845 |

According to the above table, all the accounts except the financial expense of ABC Ltd, all others have increased. Total sales increased. Meaning that number of goods and services sold by ABC Ltd have increased and generated a huge amount of revenue. However, the cost of sales also has increased. But compared to sales achieved, cost of sales is less than the sales generated. Meaning that the money generated by sales by the company was spent to make the sales, such as raw material, Equipements, machineries cost. Therefore the company gross profit has increased.

The expenses spent to generate the revenue are selling and distribution expenses, administration and other general expenses and financial expenses. All expenses have increased except financial expenses. This may be due to each year's increase in sales of the company. As demand for the goods and service increases, more number of good and services are produced. And to deliver the products to customers, costs incurred will be high such as delivery cost, transportation cost and other administrative cost related to the delivery of goods and services. Financing expenses have decreased such as rent paid, electricity, fixtures and fitting etc. As a result Net profit of ABC Ltd increased by $10,845.

Part B

Why credit manager is to blame for poor credit collection

There are certain causes why credit manager is to blame for the deterioration in the credit collection period which are beyond the credit manager.

Downturn in the economy

When the budget was formulated, during that time economy may have been in a very good condition like in a boom. Businesses earn profits and their ability to pay the suppliers would be strong. And based on credit worthiness, ABC company Ltd has released goods on credit facility during that time. After two months of time, the economy turned into recession. During recession, companies reluctant to spend money and have difficulties in paying to debtors, lenders and suppliers. Henceforth customers, who have bought goods from ABC Ltd under the credit facility, would not able to pay as agreed terms and conditions.

Liberalize credit policy

The next reason which credit manager cannot be blamed, is a formulation of credit policy terms and conditions and implementation of the policy. When developing a credit policy there are certain conditions which should take into account. For example, buyer’s strength in the market, available net profit margin, size and type of buyers, buyer’s creditworthiness and many more. Any credit policy should include the range of payment, terms, prepayment terms, installments, penalty interest, conditions of sales, methods of assessing customer, explaining credit rating and risk codes, legal actions, follow up methods, staff responsibility and authority, relationship with another and arbitration process.

If these clauses are incorporated into the policy, and customers are aware before getting into any sales and customer agreed by signing the terms, then the customer will be binding to it. As a result the credit manager would able to claim for the payment accordingly to the agreement, if a customer is disobeying the agreed terms and conditions. Therefore, it is a responsibility of policy makers of the company and senior management to come up with a strong policy and implementing it. And this could be done in coordination with a credit manager.

Another reason could be that, even if the company has a strong policy, without acting upon it, we cannot achieve what we want. For example, if the sales persons or sales manager, or senior management, issue goods without checking the credit worthiness of customer with their friends or close customers and they make own payment paying term their way without consent of credit manager.

Increased competition among suppliers

The business environment is very volatile. Competition among business increases steadily. Being proactive would be the best solution for the success of the company. During the tough competition, it is essential to revise the credit policy terms as accordingly to customer needs and affordability. Otherwise competitors would be offering more attractive conditions and they are likely to get all customers resulting gain the market share in the business sector. And ABC Ltd would not able to get enough customers to achieve the credit targets allocated in the budget.

Quality of goods and services

If the quality of the products offered by ABC Ltd is very low, then the customer will refuse to buy the products. Even if they buy the product if the quality is below their expected level, then the payment will be held for some time. And it’s a responsibility of the production department to produce the goods with good quality according to customer needs.

The goods Delaying in delivering

If the company is unable to deliver the goods at the agreed time, then the customer would not able to depend on the company. In other words, failure to deliver the promises will lead to loss of customer and low dependability. Therefore, it is important for production department to provide raw materials and other necessary material to produce goods and it’s their responsibility to deliver the goods to customers on time. If the company fails to provide this, then the customers would prefer other competitors and faces low market share and generate low profit.

Relationship with sales and credit department

The relationship between sales staffs (or sales manager) and credit manager is very important. The credit manager responsibility is that to provide further guidance to achieve sales to the sales staffs. Why manager might submit a budget estimate that is biased. And ways to Company guard against it. According to the CIMA definition of budget, it is a plan quantified in monetary terms, prepared and approved prior to a defined period of time, usually showing planned income to be generated and/or expenditure to be incurred during that period and the capital to be employed to attain a given objective.

There are types of budget, managers use when preparing the budget. One of the methods is incremental budget. The budget is prepared using the previous year budget as a basis with incremental amount is added to the new budget. Resources are allocated based on previous years resource allocations. The main advantage of this type of budget is that it is easy to understand and implement and also save time. This could be one of the reasons why budget estimates are based. The main reason is that incremental budget does not take environment changing factor into considerations. Due to changing is economy, budget need to be revised basically periodically and necessary amendments need to be done. Another problem is that, incremental budget does not have incentives to innovative ideas and to reduce cost.

Another type of budget could be fixed budget. In fixed budgets, figures are fixed at the beginning of budgetary period. Any change in circumstance, these cannot be changed. For example, due to high inflation, raw material costs (others as well, such as machinery cost, about cost, rent, electricity) increase more that which is estimated in the budget. In fixed budget this cannot be changed. Therefore, actual expenditure exceeds than the estimated value in the budget.

A good way to mitigate the budget that is based is that having shorter review periods. For example, if estimated budget is for one year. Then managers can review the budget after three month period or on quarter basis. The second way to guard the company from base budget is that to approach zero based budgeting. Budget starts from zero and items included in the budget should be justifiable to the budget holder. All expenses allocated for the whole project, should justify each activity separately and develop a questioning attitude. This helps to minimize the over spendinging and inefficient. Therefore company cannot spend more that what it is estimated and from the estimated expenditure, expected profits will be generated.

Conclusion

From above discussion, we can conclude that, increase in company gross profit would have a direct impact on net profit. Generating more sales will increase the gross profits and by minimizing the company expenses, the companies net profit would increase. And the profitability can be compared against the previous years by using ratios and trend analysis.

Secondly, businesses normally prepare the budgets annually and quarterly. Regular evaluation of budgets prevents from overspending and adjust the budgets, according to changing the environment. And also in order to achieve high credit facility a budgeted, not only the credit manager should work on it. Other department staffs like sales and senior management should play an important role in doing so.

References

- Atrill, McLaney, Harvey & Jenner 2012, Accounting an introduction, 5th edn, Pearson Australia.

- FICM, GB 1986, A© 2004 FECMA , viewed 1 December 2014, <https://www.fecma.eu/Documents/FECMA%20Credit%20Policy%20chapt%20%201.pdf>.

- McLaney, E & Atrill, P 2010, Accounting An Introduction, 5th edn, Pearson Education Limited.

- Riley, Jim 2012, Tutor2u Limited, viewed 1 December 2014, <https://www.tutor2u.net/business/accounts/incremental-budgeting.htm>.

- Schaeffer, MS 2012, Essentials of Credit, Collections, and Accounts Receivable, John Wiley & Sons, Inc., Hoboken, New Jersey, USA.

Cite this page

Financial Performance of ABC Ltd. (2017, Jun 26).

Retrieved March 4, 2026 , from

https://studydriver.com/financial-performance-of-abc-ltd/

Stuck on ideas? Struggling with a concept?

A professional writer will make a clear, mistake-free paper for you!

Get help with your assignmentLeave your email and we will send a sample to you.

Perfect!

Please check your inbox